The capital call finance market has matured over the past decade, with the majority of the GPs recognising and using capital call lines as an effective cash management tool. The growth has resulted in several new market entrants, but there has been very little in the way of innovation in capital call financing structures and efficiencies in how GPs utilise these facilities. No Limit Capital structure is revolutionising the fund financing market by providing GPs with more cost-effective and technology-led solutions at a large scale.

What is the cost of capital call facilities?

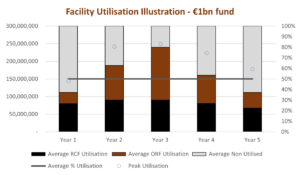

Funds typically have the ability to borrower up to 30% of the fund size and the market typically provides capital call facilities as Revolving Credit Facilities (RCFs) for that full amount. However, the estimated market utilisation average is only 40-50% of the total RCF limit. This results in GPs overpaying for these bridge lines as they incur commitment fees on the portion of the facility that is committed and undrawn, as well as being an inefficient use of banks’ capital. GPs often overlook this point as headline margin and the upfront fee is a key factor when choosing a capital call provider or they don’t think other alternatives are available in the market.

NLC’s lending structure incorporates both an RCF and an On-Request Facility reducing the overall cost of financing while providing certainty of funding. NLC estimates that on average a fund will pay an additional €2.8m per every €1bn of fund size in arrangement and commitment fees based on an average 50% utilization.

The future of Capital Call Finance Market

Capital call financing has expanded exponentially from its humble beginnings in the 1990s when only a few General Partners were using capital call financing during the fundraising period to bridge asset acquisitions between first and final close. Today the capital call financing market is estimated to be $750bn, serviced exclusively by the banking market.

The growth has been driven by two factors, record-high private capital fundraising, and most GPs recognising and using capital call financing as an effective cash management tool. It is estimated that fundraising in the private capital market is forecast to double over the next 5 years as managers raise larger flagship funds in quicker succession while introducing new strategies.

This means there will be an increased demand for capital call financing solutions putting more pressure on the banking sector as it tries to keep up with demand, while at the same time managing capital pressures due to increased regulation such as BASEL IV. As a result, GPs will have to manage a growing pool of multi-bank relationships across their funds adding complexity and cost for GPs in setting up and running their capital call facilities.

The banking sector will continue to play an important part in the capital call financing market however the growth is likely to come from alternative capital sources. Non-bank institutional investors have been looking at capital call financing as an alternative to fixed interest products as it offers an attractive risk-adjusted return. These investors bring scale and understand the sector as the majority invest into the private capital market as limited partners.

Why No Limit Capital?

No Limit Capital is the first independent fund finance lender focused on providing capital call finance to the private capital market. NLC has been set up to improve GPs capital call financing experience by increasing lending capacity, in a more cost-effective facility structure and making it simple to set up and run through NLCs’ innovative technology-led processes. We pride ourselves on building long-term partnerships with our borrowers which enable us to support them on their growth trajectories. Our investors are large global insurance and pension companies removing typical banking constraints and introducing new sources of LP capital. NLC facility structures have been standardised to reduce overall setup and running costs and are put in place for the investment period making it simple for borrowers to renew their facilities over this period.